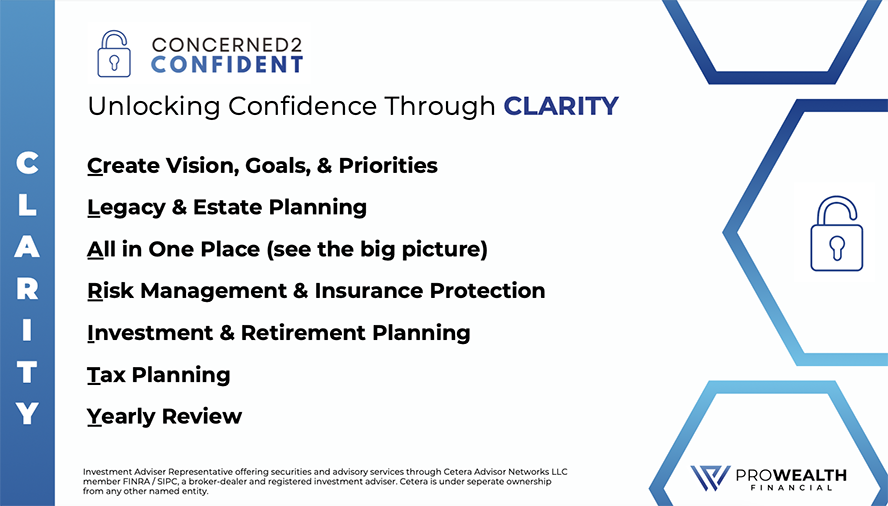

Our Concerned2Confident process is uniquely designed to serve individuals, families, and organizations that have a passion to better the communities around them. We love serving a wide variety of careers, such as government employees, educators, and healthcare professionals, from their working years through their golden years. Our specialized team at ProWealth Financial is here to unlock CONFIDENCE through CLARITY by crafting a secure financial future from a foundation of public service.

Create your vision, goals, & priorities

Legacy & estate planning

All in one place (see the big picture)

Risk Management & insurance protection

Investment & retirement planning

Tax Planning

Yearly Review

ProWealth Financial is a wealth services firm with a team of approachable, dedicated professionals who will put your needs and interests first. Our commitment to you is to provide independent, objective advice and attentive service. We understand that freedom in life is a journey that can be planned through financial focus, and we believe that helping you organize your financial life enables you to make informed decisions toward your goals and desires.

Click here to learn more about the whole ProWealth Financial group.

Eric Mullins, CFP® Certified Financial Planner (TM)

Hi, I'm Eric! I'm the proud husband to Crissie for over a decade now, and the dad to Peter (6), Adalyn (3), and our new baby, Ezra. I love spending time with my family and feel so blessed to watch these kids learn and grow. My faith in Jesus Christ is central to me, and that guides how I live my life, and why I am actively involved at my local church.

I have a heart for serving others and helping them achieve their financial goals. Over the past 13 years doing financial planning I gravitated to working with people and organizations who share my passion for making a positive impact in their communities. I know that financial concerns can hold us back from giving our best to the people, communities, and causes we care about. I have heard it put this way - “You can’t fill the cup of others when your own cup is empty.” That's why I want to help you “fill your cup” by providing CLARITY to your financial picture, so that you can confidently serve those you care most about.

Direct / Texting : (612) 895-7775

Email: EMullins@prowealthfin.com

Education and Designations:

- CFP®- CERTIFIED FINANCIAL PLANNER TM

- CRPC – Chartered Retirement Planning Counselor

- CSSCS - Corporation for Social Security Claiming Strategies designation

- University of Minnesota – Carlson School of Management

Finance and Risk Management Insurance and Economics

Awards

FIVE STAR WEALTH MANAGER* – 2018-2023

- Featured in Mpls. St. Paul Magazine and Twin Cities Business

Matt Bruno, Client Service Associate

I'm Matt - originally from Norristown, Pennsylvania, just outside Philadelphia, I currently reside in Columbia, South Carolina with my wife, Niki, and our two cats, Benny and Maggie, along with our dog, Beau.

I earned my undergraduate degree in Sport Management from Alvernia University in Reading, Pennsylvania, where I also played two years of Division III baseball. Both my wife and I are currently pursuing graduate degrees at the University of South Carolina—she is working toward her PhD in Accounting, while I am completing my MBA. As a lifelong Philadelphia sports fan (Go Birds!), I am also passionate about baseball as a high school and NCAA umpire. With over 12 years of experience in umpiring, it has grown to become a significant passion of mine.

Professionally, I bring around five years of experience in the financial services industry. I am passionate about fostering effective communication and ensuring clear collaboration across teams. I thrive in problem-solving, approaching challenges with a strategic mindset to deliver optimal solutions. I am results-driven, consistently focused on achieving goals efficiently. Furthermore, I am dedicated, hardworking, and committed to delivering high-quality outcomes in everything I do.

What is CONCERNED2CONFIDENT?

Great Question! While you’re focused on serving others it can be easy to get lost in the day-to-day concerns of life and lose sight of the bigger picture: What are YOU working toward and how can a financial plan help YOU confidently get there?

We believe thoughtful, CLARITY driven financial planning can help you live a life that you enjoy both now and into the future. CONFIDENCE comes when you have a clearer understanding of what is going on and how it affects you directly in all aspects of your financial life.

Our approach is centered around the idea that your "why" is just as important as the "how". From our first meeting, we want to know what truly matters to you. Once we've established your goals, you will receive your own personalized CONCERNED2CONFIDENT financial map designed to align your money with your needs, wants, and wishes. We're here to provide guidance for all aspects of your financial picture.

Through this CLARITY driven CONCERNED2CONFIDENT process, we aim to provide financial guidance, insights and education to help you confidentially live your life while working and throughout retirement.

Guiding Principles

Steadfast

We believe that consistency with values, goals, and a long-term view in an ever changing world around us helps to cut through the ‘noise’ and focus on what is most important to stay on track, both now and into the future.

Connected

We want to know you beyond just the dollars and cents. We know that the journey to financial confidence begins with you as a person, and what is most important to you. As we get to know each other and identify your values, goals, and priorities, it helps us to better plan for you and develops a stronger and more meaningful relationship.

Balance

We realize that life comes with many choices each and every day. As we learn to weigh the options with the potential pros and cons, we make better decisions. Our goal is to guide you with objective guidance and advice regarding your financial decisions that empowers you to choose wisely.

Ready to see how we can help you unlock confidence? Schedule an intro conversation with us to see how your own CLARITY driven financial plan can bring you closer to your goals.

*The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria - required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively registered as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not: A. Been subject to a regulatory action that resulted in a registration being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional's consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional's consumer complaint process; feedback may not be representative of any one client's experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria - considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth managers. Award does not evaluate quality of services provided to clients. Working with a Five Star Wealth Manager does not ensure that a client or prospective client will experience a higher level of performance or results. The inclusion of a wealth manager on the Five Star Wealth Manager Award list should not be construed as an endorsement of the wealth manager by any client nor are they representative of any one client's evaluation. The Five Star award is not indicative of the wealth manager's future performance. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. Listing in this publication and/or award is not a guarantee of future investment success. This recognition should not be construed as an endorsement of the advisor by any client. No compensation was provided directly or indirectly by the recipient for participation or in connection with obtaining or using the third-party rating or award.